I’ve spent the last 2 decades in the climate/clean energy/sustainability sector. However it is only in the last two years that I find myself increasingly in conversations at conferences and other industry events, as well as with aspiring graduates that want to join the “climate field”, where I see a growing aversion to “dirty money”; dirty money being defined as having ties to anything related to fossil fuels and environmentally harmful industries. I’ve heard lengthy arguments from people around the world about their preference to not be associated with dirty money jobs or a preference to use clean money to fund the climate transition. Afterall, it makes sense; to make the world a better place, why not start with money that has no ties to fossil fuels.

Is there such a thing as true clean money?

If you already know where this exists, don’t bother subscribing; if not subscribe and follow along.

As demand for ESG and climate tech investment rises, the integrity of these funds’ origins and practices has come under greater scrutiny. This scrutiny centers on "greenwashing," a phenomenon where firms or funds may claim environmental benefits while ultimately being tied to fossil fuels or other polluting industries.

Unfortunately, numerous climate tech funds and initiatives face an uncomfortable reality: much of their capital can be traced to sources that are also heavily invested in fossil fuel-based industries.

Dirty money in venture capital and private equity

The venture and private equity worlds have often and continue to be fueled by large sums of money from institutional investors—LPs such as pension funds, endowments, and family offices. While the drive toward clean investments has influenced some of these sources to shift their strategies, many still have strong historical ties to fossil fuel investments. A significant proportion of capital flowing into VC and PE comes from sovereign wealth funds, which often hold diversified portfolios that include fossil fuels.

In August, 2024, Urgewald and 17 NGO partners released a report titled Investing in Climate Chaos, that reveals the fossil fuel holdings of over 7,500 institutional investors worldwide. Among the filthy five, Vanguard holds the record as the biggest fossil fuel investor.

Source: Investing in Climate Chaos (assets under management)

Here is a short breakdown of where Vanguard allocates its investments in climate-related areas, and the challenges surrounding these efforts:

Vanguard ESG U.S. Stock ETF (ESGV) and Vanguard ESG International Stock ETF (VSGX): These funds avoid direct investments in fossil fuels, gambling, and other non-ESG-aligned industries. They focus on companies with high environmental and social performance, emphasizing lower emissions, sustainable practices, and minimal environmental impact.

Vanguard Global ESG Select Stock Fund: This is an actively managed ESG fund that invests globally in companies with strong environmental performance and governance standards. The fund has a “best-in-class” approach, selecting companies within each sector that lead in sustainability.

Vanguard SRI Funds (Socially Responsible Investing): These funds are generally free of direct fossil fuel investments, focusing instead on companies leading in renewable energy, sustainable materials, and climate-friendly technology.

Investments in renewable energy and climate solutions: Through its ESG funds, Vanguard indirectly invests in climate solutions companies, including those in renewable energy, electric vehicles, and sustainable technology sectors. Major holdings often include firms like NextEra Energy, a leader in renewable energy production, and Tesla, a high-profile electric vehicle manufacturer. However, these are typically part of larger index funds rather than specialized climate funds.

Global Bond Funds: Vanguard has started offering bond funds with green or sustainability-focused bonds, which are issued by companies or governments to finance environmentally friendly projects. These funds allow investors to indirectly support climate-friendly initiatives while seeking returns in fixed income.

Other notable LPs with fossil fuel ties are:

Norwegian Government Pension Fund Global: Despite Norway's $1.6 trillion sovereign wealth fund pushing into sustainable investments, the origins of its funding are based on oil revenue. They’ve invested billions into green projects but face criticism due to the fossil fuel origins of their assets.

Saudi Arabia’s Public Investment Fund (PIF): The PIF has become a major player in tech investments, including renewable energy, but remains deeply entrenched in fossil fuels. According to a report from Reuters, the PIF announced its intentions to invest $15 billion in Brazil, in areas including green hydrogen, infrastructure and renewable energy.

A 2021 study by the Climate Action 100+ initiative revealed that only 3% of surveyed LPs had fossil-free portfolios. However, achieving a fossil-free portfolio is complex and carries risks, as traditional energy sources have historically been a dependable source of returns for LPs.

Dirty origins pave the way for a cleaner future?

Despite the continued influence of fossil-fuel-rooted LPs and amidst the growing criticism of their investments in and ties to fossil fuels, private equity firms are investing heavily in sectors that promote climate resilience. Here’s an overview of key areas where private equity funds are deploying capital in climate-related projects:

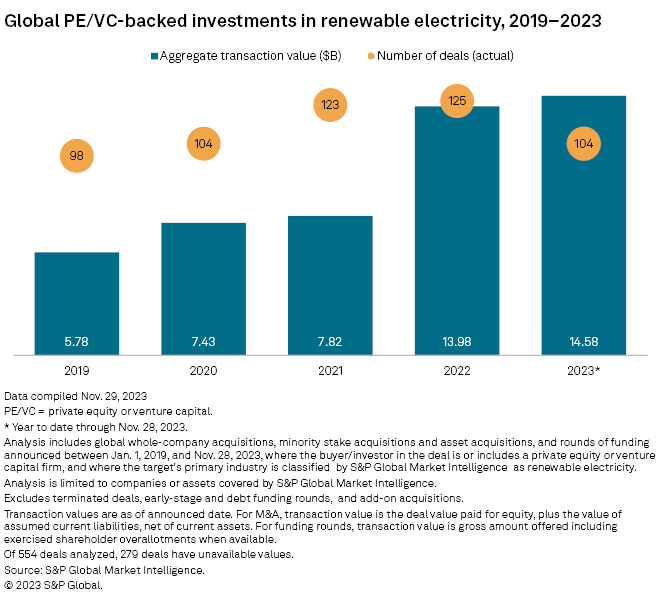

Renewable Energy Projects: Solar, wind, and energy storage projects are receiving substantial PE investments, with firms like Blackstone and KKR committing billions to renewable energy infrastructure. According to S&P Global, PE and VC transactions in the global renewable electricity sector reached nearly $15 Billion, between 2019-2023, a 5-year high.

Source: S&P Global Market Intelligence

Carbon Capture and Sequestration: Technologies that can capture and store carbon emissions are attracting attention, particularly from funds that seek to mitigate their own carbon footprints. Firms like Oxy Low Carbon Ventures and Summit Carbon Solutions have gained traction with private equity backing. BlackRock as an example, announced a $550 million investment in Stratos, which could likely become the world’s largest direct air capture (DAC) facility.

Sustainable Agriculture: To address the significant carbon footprint of agriculture, PE firms are exploring investment in sustainable agricultural technologies that reduce methane emissions and improve soil health. According to research by AGD Consult;

“From 2005 to 2014, more than 200 new investment funds began operating in the food and ag sector, accounting for approximately US$44 billion in assets under management.”

Electric Vehicle Infrastructure: The push for EV adoption has prompted substantial PE investment in charging infrastructure, with firms like EQT and Brookfield Asset Management leading major investments. According to S&P;

“In aggregate, global private equity and venture capital investments in electric vehicles and components stood at $9.45 billion through the first 10 months of 2022, compared to a record-high total annual investment of $12.64 billion in 2021, according to S&P Global Market Intelligence data. The next-highest annual total was in 2020, when private equity invested $9.52 billion in the electric vehicle industry.”

Chasing clean money in climate is a complicated path. What are your thoughts on this?

Infographic of the week (IOTW) - The trillions in fossil fuel developers

According to Urgewald.org;

The institutional investments of $4.3 trillion in the fossil fuel industry can be broken down as follows: Less than one third, $1.2 trillion, are invested in bonds and shares of companies on the Global Coal Exit List (GCEL). $3.8 trillion or 88% are invested in companies on the Global Oil & Gas Exit List (GOGEL). $0.7 trillion are invested in companies listed on both GCEL and GOGEL