The need for sustainability financing has been written about consistently. In the global climate transition, where we are going to need a variety of climate technology solutions, not all flavors or solutions have always received the same amount of attention and funding, globally. As organizations around the world increasingly commit to their own sustainability goals (ESG), a new class of financing has come about that incentivizes progress that companies make toward their goals, and penalize them when they don’t.

A single Sustainability-Linked Loan (SLL) can include multiple goals, called Sustainability Performance Targets. For example, a borrower might set goals to cut greenhouse gas emissions by 4% each year, improve water efficiency by 5%, and increase the number of women on its board. Each year, the company must report its progress on these targets to lenders.

If a borrower falls short on their goals, the interest rate goes up; if they meet or exceed the targets, the rate goes down. This creates a reward-and-penalty system—though it only works effectively if the interest change is significant. The first SLLs were issued in 2017 and this market has since grown rapidly, largely because of the flexibility these products offer.

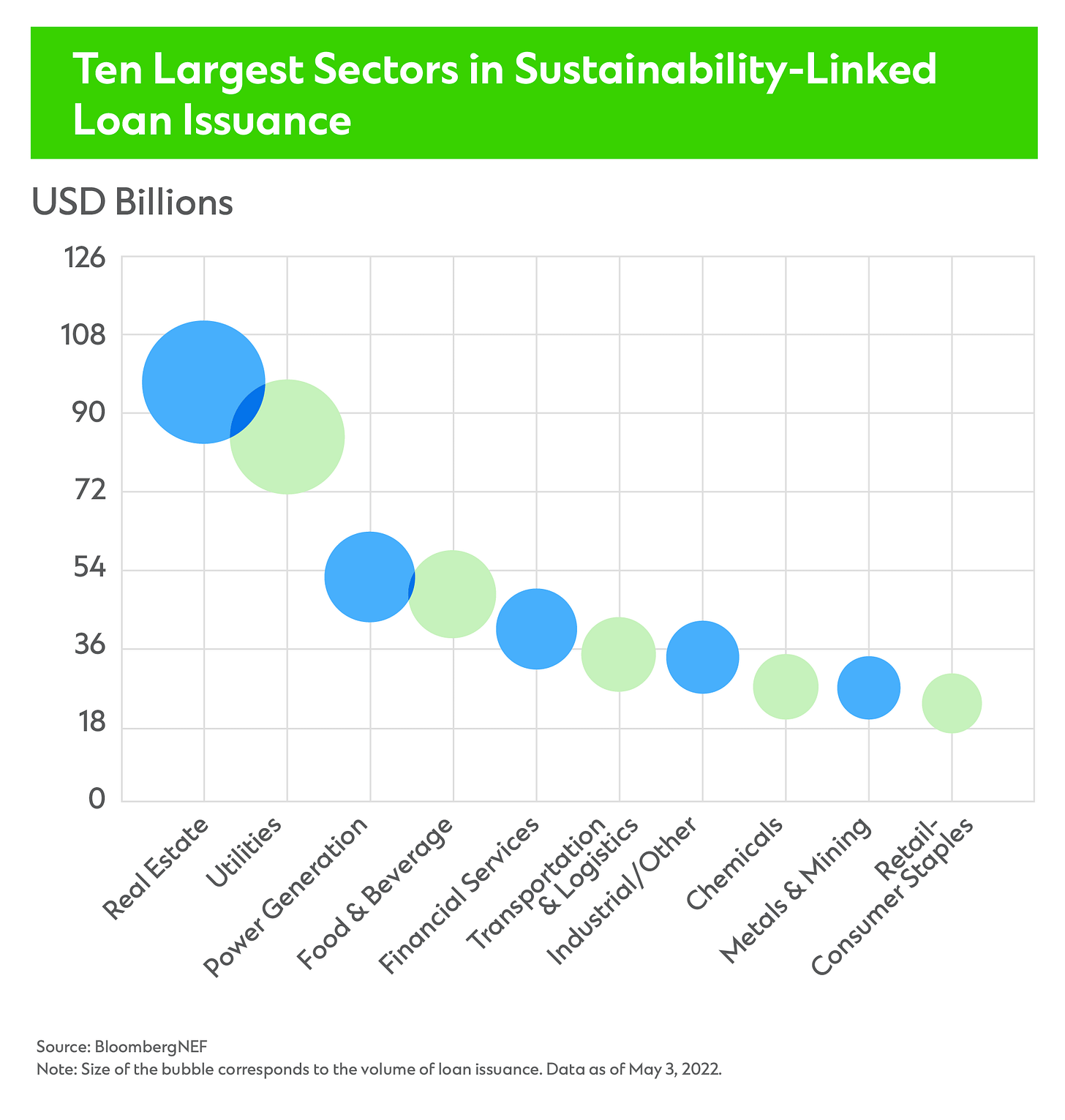

In 2022 alone, sustainability-linked loans globally reached over $700 billion (according to estimates from BloombergNEF). Much of this $700 billion has supported projects in renewable energy (like wind and solar), energy efficiency upgrades, green building construction, and sustainable supply chains. Additionally, waste reduction, water conservation, and circular economy projects are frequent beneficiaries, with companies incentivized to meet specific ESG (Environmental, Social, Governance) targets. The following table from BloombergNEF summarizes the types of sustainable debt.

Terms and conditions of sustainability loans

The terms of sustainability loans vary but generally follow a structure that incentivizes borrowers based on their ESG performance. Here are the key elements:

Interest Rate Adjustments: Most sustainability loans feature a “margin ratchet” mechanism, where the interest rate decreases if the borrower achieves predefined sustainability targets and can increase if they fall short. Typical targets include reductions in emissions, energy use, or waste production.

Performance Metrics and KPIs: Borrowers and lenders agree on specific performance metrics tied to the company’s sustainability objectives. These may include reducing water usage, increasing renewable energy sourcing, or achieving certain recycling or waste diversion rates.

Third-Party Verification: To ensure transparency, borrowers may be required to undergo annual third-party verification of their ESG performance. This ensures that reported metrics accurately reflect the company’s sustainability achievements.

Loan Amount and Use of Funds: Sustainability loans vary in size but typically finance projects like renewable energy installations, energy-efficient equipment upgrades, waste management systems, and sustainable product development. They can range from millions to billions in scale, depending on the borrower’s size and goals.

Are SLLs a boon for social causes?

Like anything, despite the versatility of SLLs and the flexibility they offer, not all organizations have equitable access. Commonly funded initiatives include:

Waste Reduction and Circular Economy: Many sustainability loans support waste reduction initiatives, including recycling programs, composting, and innovative circular economy approaches where materials are reused or repurposed.

Water Conservation: Companies in water-intensive sectors may use loans to implement water recycling, efficient irrigation, or conservation technologies to meet ESG targets.

Sustainable Supply Chain Initiatives: By investing in sustainable sourcing and waste reduction within their supply chains, companies can use sustainability loans to improve transparency and environmental impact.

High-impact areas crucial for climate resilience, such as sustainable agriculture, climate adaptation, and certain infrastructure sectors, often face challenges in securing sustainability loans. Here are some key areas, examples of projects that struggled to secure funding, and successful projects that moved forward:

Agriculture and land use

Loan Issuers: Development banks and programs such as the World Bank and International Finance Corporation (IFC) aim to address agricultural sustainability but often face logistical challenges, especially in smaller or poorer regions.

Example of Unfunded Projects: In Kenya, some regenerative farming cooperatives struggle to access capital due to high upfront costs and a lack of infrastructure for ESG compliance.

Funded Example: The IFC has supported a sustainable cocoa initiative in Côte d'Ivoire to promote eco-friendly practices in cocoa production, benefiting both farmers and ecosystems. The IFC and the Global Agriculture and Food Security Program (GAFSP) invested in a US$9 million risk-sharing agreement alongside Barry Callebaut to help up to 100,000 smallholder cocoa farmers access much needed credit.

Climate adaptation projects

Loan Issuers: Large banks, government funds, and the United Nations Green Climate Fund (GCF) prioritize projects for emissions reductions but often deprioritize adaptation efforts.

Example of Unfunded Projects: Coastal adaptation efforts in Bangladesh, such as early warning systems and resilient infrastructure, have struggled to secure consistent funding due to lack of profitable return projections.

Funded Example: In Fiji, the GCF funded an initiative to bolster climate resilience for coastal communities, targeting infrastructure improvements to withstand rising sea levels.

Low-Income country renewable energy

Loan Issuers: Multilateral development banks (MDBs), like the Asian Development Bank (ADB) and African Development Bank (AfDB), fund renewable projects but face challenges in high-risk markets.

Example of Unfunded Projects: In Uganda, mini-grid solar projects for rural communities have faced financial barriers due to limited loan accessibility and perceived risk.

Funded Example: The AfDB successfully funded an off-grid solar program in Nigeria that aims to connect over 500,000 households, helping to close the energy gap and reduce reliance on fossil fuels.

Small and medium enterprises (SMEs)

Loan Issuers: National banks and private equity funds focus on larger projects, leaving SMEs with fewer financing options for green transition projects.

Example of Unfunded Projects: In India, small businesses in the textile industry lack funding for waste management upgrades due to high loan rates and requirements for stringent ESG documentation.

Funded Example: Banco Santander provided a sustainability-linked loan to an SME in Spain’s agriculture sector, incentivizing sustainable land use with favorable loan rates tied to environmental targets.