While the West Slows and Risks Penalties, China Hits the Accelerator on EVs

And infographic of the week

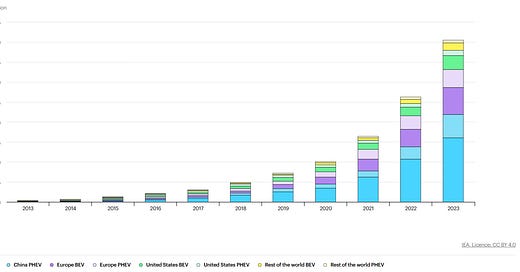

In recent months, several major automotive manufacturers in the U.S. and Europe have revised their electric vehicle (EV) strategies, either by reducing production capacities or delaying the introduction of new models. In stark contrast, China is accelerating its dominance and solidifying its position as the global powerhouse. this week we look at the data and review what might be causing these contrasts. Let’s first look at the automotive companies in the west that have retracted their plans to scale EVs.

Source: IEA

Before you scroll, please take a moment to share this newsletter, on Substack and through other channels, within your network.

General Motors (GM)

Reduction in EV Production Targets: In June 2024, GM lowered its EV production forecast for the year. By July, the company refrained from reaffirming its earlier goal of producing 1 million EVs in North America by 2025.

Rationale: GM's decision is influenced by a combination of factors, including slower-than-expected consumer demand for EVs, challenges in scaling production efficiently, and the substantial investments required for the transition to electric mobility.

Ford Motor Company

Delays and Cancellations of EV Models: In August 2024, Ford canceled plans for an all-electric SUV and postponed the release of its electric T3 pickup truck. The company had delayed its goal to sell only battery electric passenger cars in Europe by 2030, deeming the target "too ambitious."

Rationale: Much like GM, Ford’s decision was influenced by slower-than-expected demand for EVs. The company is shifting focus toward hybrid technologies to balance costs and consumer demand.

Volvo

Adjustment of electrification goals: In September 2024, Volvo revised its objective to become an all-electric car manufacturer by 2030. The company now targets 90% to 100% of its global sales to consist of electrified cars by that year, including a mix of fully electric and plug-in hybrid models.

Rationale: Slower-than-expected consumer demand, reduction of incentives for EV purchases, and the possibility of increased tariffs on Chinese-made cars were reasons that Volvo cited for this adjustment.

Toyota Motor

Continued Production of Internal Combustion Engine (ICE) Vehicles: Toyota has indicated that it will persist in manufacturing cars with "electrified internal combustion engines" well into the next decade, rather than transitioning exclusively to battery electric vehicles.

Rationale: Toyota's strategy reflects a cautious approach to electrification, emphasizing a diversified portfolio that includes hybrids and other electrified ICE vehicles.

Lotus Technology

Reduction in Sales Targets: In August 2024, Lotus Technology, a subsidiary of Geely, cut its 2024 sales target by 54%, reducing the goal from 26,000 to 12,000 units. This adjustment includes both EV and ICE vehicles, with a significant portion being electric.

Rationale: The company’s rationale mirrors all others’ above. The company attributes this decision to poorer-than-expected first-half financial results and market uncertainties, including potential tariffs in the European Union and the United States, which could affect pricing and demand.

Meanwhile several states have adopted mandates requiring a transition to zero-emission vehicles (ZEVs), with penalties for automakers that fail to comply. These mandates are primarily based on California's Advanced Clean Cars II regulations, which stipulate that by 2035, all new passenger cars, trucks, and SUVs sold in the state must be zero-emission vehicles. These states include California, New York, Massachusetts, Oregon, Vermont, New Jersey, Maine, and Washington. Automakers that fail to meet the ZEV sales requirements in these states may face various penalties, including fines and restrictions. The specific penalties vary by state but generally involve financial penalties proportional to the shortfall in meeting ZEV sales targets. For instance, in California, manufacturers not complying with ZEV credit requirements may purchase credits from other manufacturers or face fines. The exact penalty structure can differ, but the overarching goal is to incentivize manufacturers to increase the production and sale of zero-emission vehicles.

It's important to note that while these states have adopted California's standards, the implementation and enforcement mechanisms, including penalties for non-compliance, may vary. Automakers operating in these states must adhere to the respective regulations to avoid penalties and contribute to the nationwide effort to reduce greenhouse gas emissions through increased adoption of zero-emission vehicles.

China's EV Boom: A Stark Contrast to the West

While Western automakers grapple with wavering demand and temper their EV ambitions, China is charging ahead, solidifying its position as the global EV powerhouse. The booming EV market in China is not just a phenomenon but a testament to the country's robust policy support, burgeoning middle class, and forward-thinking industrial strategy. According to the IEA;

While sales of electric cars are increasing globally, they remain significantly concentrated in just a few major markets. In 2023, just under 60% of new electric car registrations were in the People’s Republic of China (hereafter ‘China’), just under 25% in Europe,2 and 10% in the United States – corresponding to nearly 95% of global electric car sales combined. In these countries, electric cars account for a large share of local car markets: more than one in three new car registrations in China was electric in 2023, over one in five in Europe, and one in ten in the United States. However, sales remain limited elsewhere, even in countries with developed car markets such as Japan and India.

This dominance in the EV market is further boosted by the fact that China controls over 80% of world’s battery materials processing capacities, giving it a significant edge over western counterparts. The Chinese government has aggressively supported EV adoption through subsidies, tax exemptions, and investments in infrastructure. As of 2023, there were over 1.8 million public EV chargers in China, dwarfing the combined infrastructure in Western countries.

The Road Ahead

China’s EV surge highlights a compelling narrative: a combination of proactive policy, manufacturing leadership, and consumer alignment can drive mass EV adoption. As Western automakers re-evaluate their strategies, they face a pivotal question: Can they learn from China’s success, or will the gap continue to widen? In the West, challenges like high vehicle costs, lagging infrastructure, and policy inconsistencies have stymied progress.

What are your thoughts on the topic?